A Business Credit Application Form Template is a model of Business Credit Application Form that any lending company requires to acquire the necessary data from the businesses that are applying for the credit.

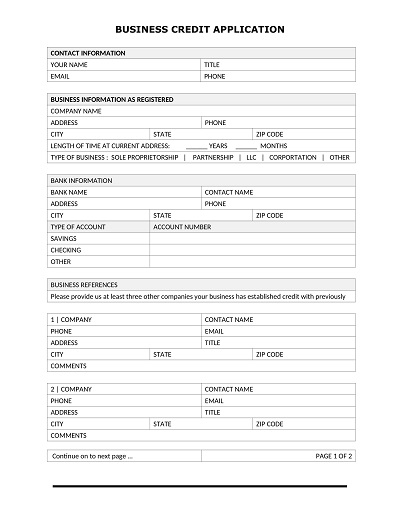

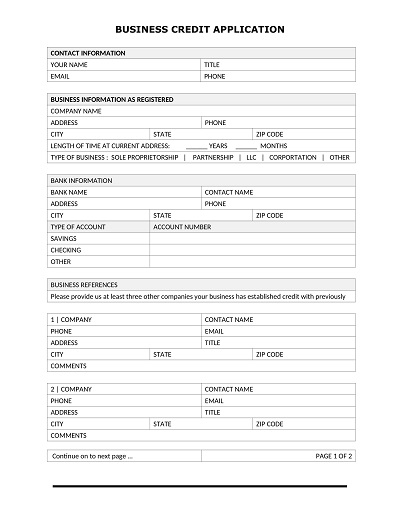

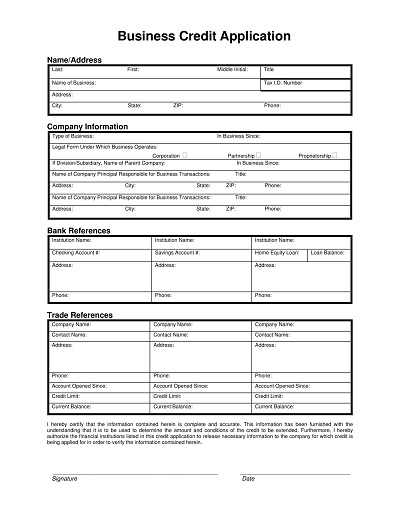

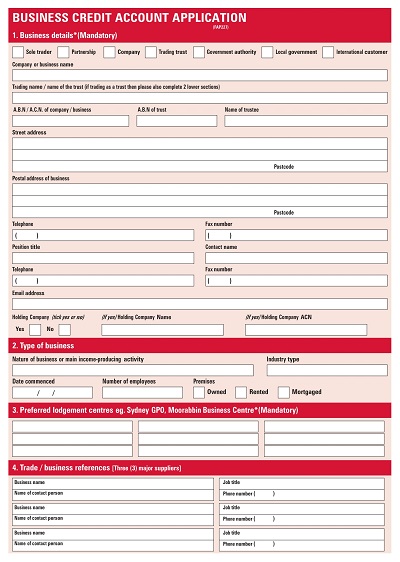

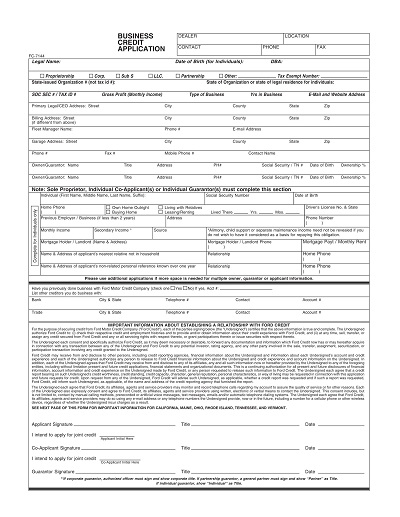

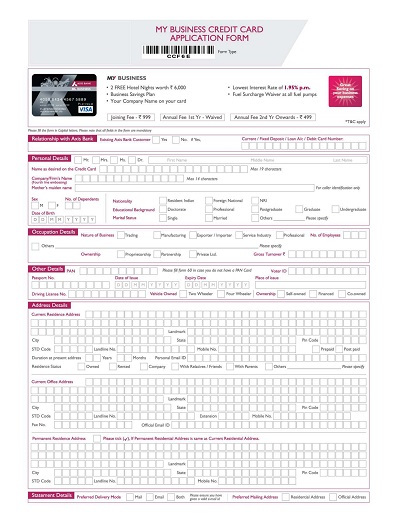

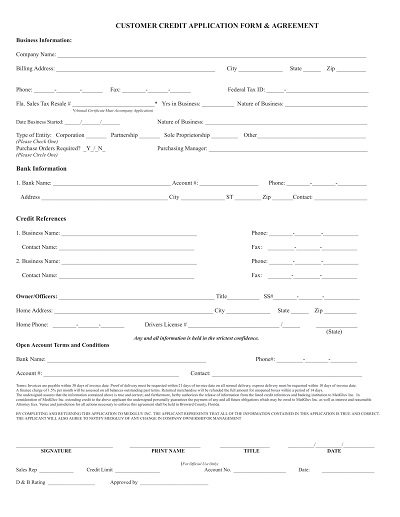

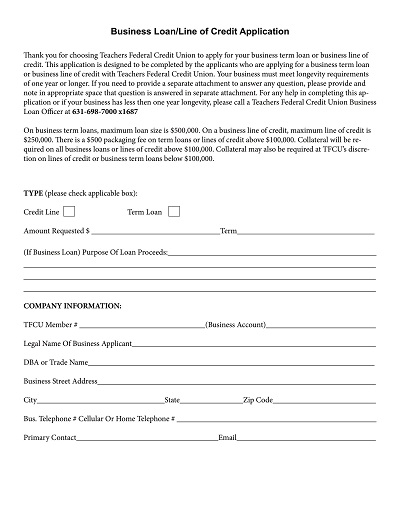

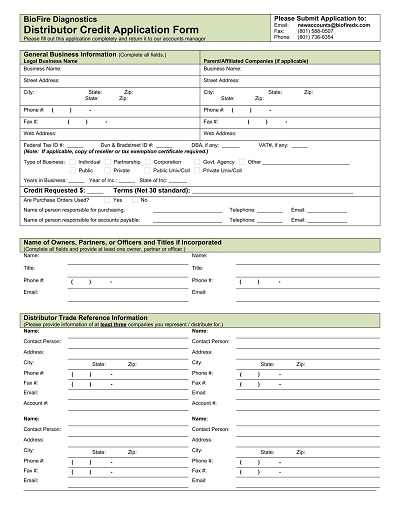

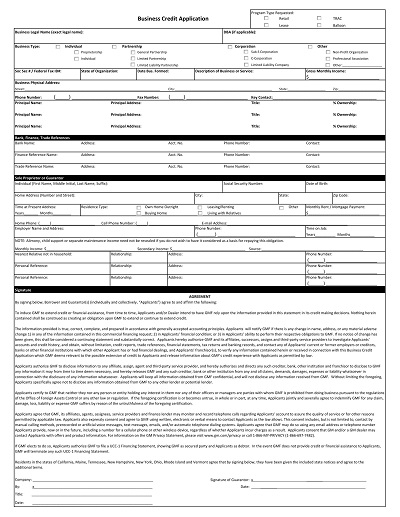

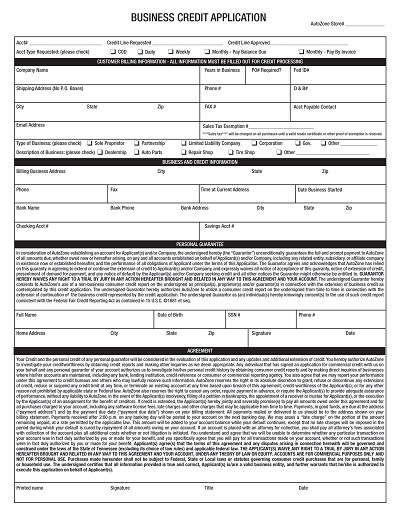

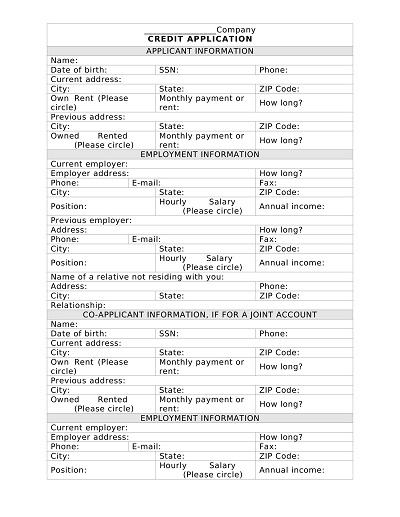

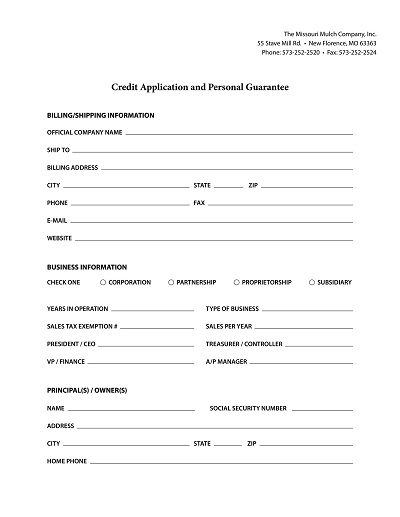

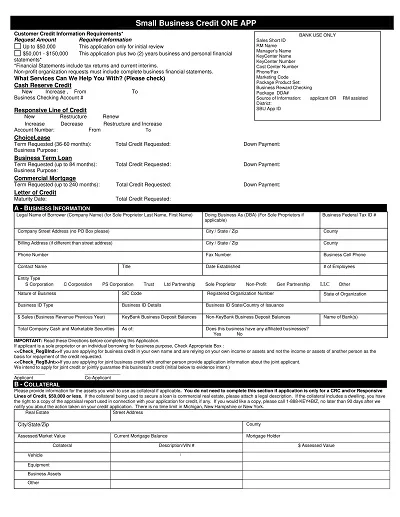

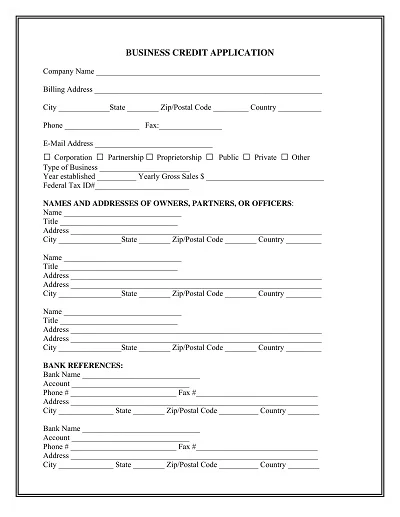

Contents showA standard format usually incorporates elements like the business details section in which details like the legal name of the business, type of business, the number of years the business has been in operation, full details of the owner, and banking details like bank account details, trade references and financial statements among others are provided.

Therefore, a business credit application form is an important document that lending institutions, suppliers, and other businesses use to analyze the business’s credit standing. This type of application often demands a lot of information about the business, such as its name, nature and ownership, balance sheet references, etc.

Submitting this form then triggers a credit verification process that facilitates the evaluation of the firm’s creditworthiness in extending credit lines or giving loans to the business. This is because the identification process is the initial step in creating a rapport between business counterparts and financial entities or suppliers.

A business credit application form is helpful in terms of organization and could also be used in maintaining records in a particular company.

Here are several key benefits:

Since it enlightens the firm on the credit history of various customers, it helps in evaluating their credit positioning accurately. Even though the various risks associated with credit extension might exist, businesses can minimize them by assessing the financial statements that are usually submitted.

The form is also very useful in remitting cash to the company account and in undertaking the management of the company’s cash flow. Credit research provides valuable information regarding customers’ financial capabilities to repay through planning and efficient distribution of resources.

The evidence that can be provided through a credit application protocol is useful in case there is a dispute about any issues arising from the application. It guarantees that the documentation of all business transactions is done comprehensively and the credit terms of a transaction are well formulated.

This is useful when one can be in a position to determine the payment option, in the beginning, to avoid messing around with the customers.

Components of a Business Credit Application Form include:

Completing a business credit application form would be important for businesses that seek to build or expand their credit lines. This written report helps the business secure funds from lenders, suppliers, or leasing companies to meet the price of the required products or services, or even machinery and equipment that is needed for running the business without having to make payments upfront.

Businesses must fill out the forms as an affirmative action of sound capital position and credit standing that opens the doors for initiating a partnership between the firm and the creditors. This process can be important for nurturing growth, controlling cash flows, and achieving the funding leeway vital in today’s ambitious world.

Here are some tips for using a Business Credit Application Form Effectively:

Make sure that the credit application form that is used by the business is simple to comprehend as well as to fill out. This could be due to complexities of the terms being used or ambiguity in the instructions given, therefore giving out wrong and partial data, which may cause some delay in the processing. Even if the case has clear and concise questions, the collected data can be improved.

Keep the questions to only primary data that has a direct impact on the rating of the credit. This includes the trading name of the business, address, phone number, business type, and some financial details as well as the reference contacts. However, adding too many questions in the form may lead to few people applying for the position because the form acts as a turn-off.

To further inspire confidence, use statements regarding the applicant’s data usage and protection for their data on your website or platform. This builds confidence and results in more businesses applying knowing that their information will be well dealt with.

Provide a set of guidelines on how the form should be filled in and the subsequent actions in case the form is returned. Explain how to submit the form, if it is available online via email or personally, then indicate any other supporting documents that need to be included.

Once the application is received, it is critical to ensure that the various authors who review the application do so very efficiently. The lender should not leave the applicant waiting for long because this may make the applicant annoyed and look for credit reformation from other places. He states that follow-up and timeliness indicate business etiquette and a high level of commitment.

The process of developing a business credit application template is a series of important steps that help to design the list of questions that would be necessary for collecting the applicant’s information successfully.

Follow these steps to develop an effective template: